Toronto Horse Palace - Time to Hitch Up the Wagons

The Ontario Feed-In-Tariff Supply Chain Forum, bringing together key executives from virtually all industry interest groups on April 19-20, is barely a month away. There will be lots to discuss.

Last week one of the leading solar industry analysts, Travis Bradford, observed that “Ontario has used every procedural trick in the book to slow down the (PV project approval) system”.

Unfortunately, there appears to be more than a little truth in that statement.

The Ontario Solar Program has faced a variety of challenges

- Domestic content requirements and a WTO trade dispute

- Unexpected changes to FIT rates that dropped the rate of applications

- Off again/On again inclusion of Commercial Aggregators

- Grid constraints

- Increasing application fees and increased red tape

- Slow approval process

- Disconnect between application approvals and actual installations

The situation is such that on March 8 the Canadian Solar Industry Association (CanSIA) in a welcome move announced it was pursing “Unprecedented Technical Roundtable Reviews Concerns and Aims to Set Goals Moving Forward”. More discussions are planned, and Hydro One has committed to provide updates on the status of microFIT contracts and provide greater detail on why they are not being connected.

FIT Rates try to overcome program changes

Just a year ago, the Ontario Solar FIT program was basking in praise from Deutsche Bank. The relatively high FIT rates did have had their critics, however. A review of Ontario FIT program activity underscores that high FIT rates alone cannot solve the challenges of grid constraints and changing program requirements.

February brought two program changes that appear to have affected the microFIT program application approval rate, potentially offsetting the benefits of the favorable decision to allow market facilitating Commercial Aggregators.

New Assessment test, higher fees

On February 9, 2011 the Ontario Power Authority (OPA) announced that all new and pending small projects would be required to obtain a connection impact assessment from their local distribution company.

Following the requirement for a new ‘connection impact assessment’, the Ontario Ministry of the Environment gave notice of an application fee hike to a minimum of $1,000 for non-residential (non-microFIT) and non-rooftop systems.

Applications Face Ongoing Delays

The good news from Ontario is that on February 24, there were 257 MW of solar projects approved after passing Transmission and Distribution availability tests. The microFIT web site advises that “High volumes of applications are resulting in processing delays. Applications received up to December 31, 2010 will be processed by March 31, 2011”. If so, that would be a welcome achievement.

In the case of the microFIT program, since the rule change there has actually been a twenty-fold drop in the rate of new Conditional Offers from over 2,000 per month to just over 100 per month.

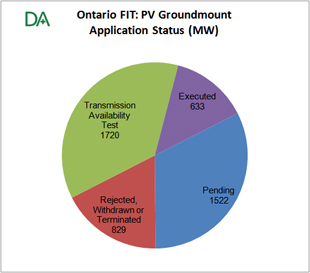

Most Groundmount applications wait for Transmission availability or get cancelled

Other Ontario FIT programs looking for faster approvals

The microFIT is not the only Ontario solar program needing faster application approvals.

According to the OPA’s FIT and microFIT reports, in the past five months, there have only been two Conditional Offers provided for new PV Rooftop applications.

In the case of PV Groundmount applications, a number of projects have recently progressed to the ‘Transmission Access’ queue.

2011 a make or break year

As Tim Wohlgemut of Clear Sky Advisors recently observed, “2011 will be the year that matters most for solar energy in Ontario.”

All of this should make for great dialog and debate – and hopefully a few answers – when the Ontario Solar Industry leaders meet at the Ontario Feed-In-Tariff Supply Chain Forum in Toronto April 19 and 20. We will be looking for a large increase in application approvals in advance of the Forum.

Previous d-bits posts on the Ontario Solar PV FIT and MicroFIT programs:

- Commercial Aggregators Allowed Back into Ontario Solar Market

- FITs and Starts – Ontario’s Green Energy Growth

- CanSIA Annual Conference – Why Ontario Needs Solar

- Ontario Domestic Content Drives Interest and Angst

- Rate Drop Reduces Ontario Solar FIT Applications

- US and EU Challenge Ontario Solar FIT Domestic Content Rules

- Ontario microFIT Advisory Panel formed, Japan Challenges Solar Domestic Content

- Reactions to Ontario’s Solar FIT Program Changes

- Concessions and New Restrictions for Ontario’s Solar FIT Program

- Update on Ontario PV Ground-Mount Tariff Changes

- Comparing PV Feed-In-Tariff Programs from Ontario and Germany

- Ontario’s Growing Pains: Will the Wind and Solar Industries Scale-up in Time?

- PHOTON Magazine Says Ontario Guides the Way

- Ontario FIT Program Changes Generate Controversy amid Compliance

- Ontario FIT Program: Definitions are Changing

- Ontario Power Authority Announces Change on Short Notice

- The Feed In Tariff is Energizing Ontario

- Ontario Domestic Content

2 Responses to “Is the Ontario Solar FIT Program Losing Momentum?”

Trackbacks/Pingbacks

- Ontario Feed-In Tariff Forum - Local Content Setting Example | d-bits - [...] One, the province’s transmission system operator and largest distribution system operator, has refused grid connections for FIT and the…

There is one important inaccuracy in this story: the $1000 fee that is described is specifically NOT for microFIT (residential) PV or ground-mounted PV under 12kW (and several other classes), according to the link that is provided.

A more minor problem is the report that the number of conditional offers has dropped from about 900-1,000 per reporting period, to about 100. This is only true for the two reports right before the rule change (“Thou shalt get LDC approval first”), and is typical of what happens at the OPA when they are about to announce a change. In this case, they would have done this so as not to approve applications which did not have LDC connection approval, which would lead to a later refusal, and more negative reactions.

Thanks for the clarification on the Environmental fee changes.

I had focused on the schedule rather than the exclusions – which admittedly are closer to the top of the page. I should have been more careful here – and have made the appropriate annotation.

As for the OPA holding off on approvals. Your explanation makes sense.

Please note, however, that it is not yet clear what a typical OPA action is with respect to application approvals.

This is not to be critical of staffers at the OPA, who I know are working hard on this program. Program changes represent a lack of consistency, and this is the core issue. This goes back to an earlier post almost a year ago (“The Feed In Tariff is Energizing Ontario”), and an observation at that time:

“Q-Cells Van Gerven said his company can live with the DCRs. He said the key to establishing a thriving renewable-energy market in Ontario is stability. “For us, from an industry perspective, we don’t like rules to be changed,” adding that a stable environment makes project financing easier to secure

https://d-bits.com/the-feed-in-tariff-is-energizing-ontario/

The current microFIT backlog is over 6,000 applications – roughly nine months worth (i.e. nine months behind)at the current pace of new applications. The OPA has committed (as noted on the site) to process all applications received prior to December 31 by the end of March. There are roughly 4,000 applications that fall into that category.

Yet, the LDC approval requirement applies retroactively and the two objectives (the program change and the commitment to process) are in conflict.

Though the OPA is almost certainly going flat out to manage the program, implementing a new requirement and purposefully slowing down approvals is a self-imposed conflict. As noted, this program could benefit from greater consistency.

The biggest challenge – illustrated in the chart but not commented on in the text – appears to be the large disparity between Offers and Executed installations. There have been 4,071 ‘Executed’ applications in the year and a half since the program’s inception and 16,000 offers extended.

If the program continues at this pace, assuming 50% of applications are terminated (consistent with the current pace on terminations), it will take another three years just to deal with the current backlog of offers, let alone pending and new applications.