With its extensive history and successful implementation, the German solar PV Feed-in-Tariff (FIT) program has become the reference for all others. Shortly after the launch of the Ontario FIT program, Deutsche Bank praised the Ontario program by noting, “Two of the most advanced FiTs in our view at present are Germany and Ontario.”

With its extensive history and successful implementation, the German solar PV Feed-in-Tariff (FIT) program has become the reference for all others. Shortly after the launch of the Ontario FIT program, Deutsche Bank praised the Ontario program by noting, “Two of the most advanced FiTs in our view at present are Germany and Ontario.”

Recent proposed changes within the Ontario MicroFIT program (sub 10 kW projects) to distinguish between residential roof mount and ground mount projects have, however, generated considerable controversy and concern. There are 11,000 previously submitted applications at risk. The retroactive nature of the proposed changes has prompted applicants to request refunds from their providers. These refund requests are straining a critical portion of the industry just when it is most financially exposed by the investments it has had to make in order to scale to meet FIT generated Ontario demand.

In contrast to the reaction of its proposed changes announcement on July 2, the Ontario Power Authority (OPA) had received acclaim for its transparency in establishing its FIT program in the first place. Industry participants and stakeholders, including Mike Brigham of the 4,000 member Ontario Green Energy Act Alliance, have requested transparency on the OPA’s FIT financial model, and release of the model itself, to understand the rationale for the tariff change.

Given the Deutsche Bank endorsement, the magnitude of the proposed changes and subsequent strong negative response are surprising and generate a number of questions.

Did Deutsche Bank miss important distinctions in its endorsement of the Ontario FIT program? Are there aspects of the Ontario program that could have been studied more closely to anticipate change and avoid surprise? Or, are the proposed changes and their challenges just “Part of the growing pains of a very successful program”, as Ben Chin, OPA Vice President, Communications, suggested during the July 6 OPA feedback session?

Unlike the Germany FIT program where FIT rates are government legislated, rates within the Ontario program are controlled by a governmental authority – the Ontario Power Authority (OPA). The OPA has the charter to change FIT rates and rate classes. What may have appeared as a subtle difference in FIT program implementation has now been demonstrated otherwise.

While this rate-setting capability of the OPA is drawing attention, it may be useful at this time to consider a larger comparison of the German and Ontario FIT programs. Are there other subtle differences that may cause market discord in the future?

These are comprehensive programs, with many different aspects. Some of these aspects, such as the FIT rates, draw more attention than others. In the case of the proposed Ontario MicroFIT changes, it is the apparently subtle and minor differences that can result in the greatest impact.

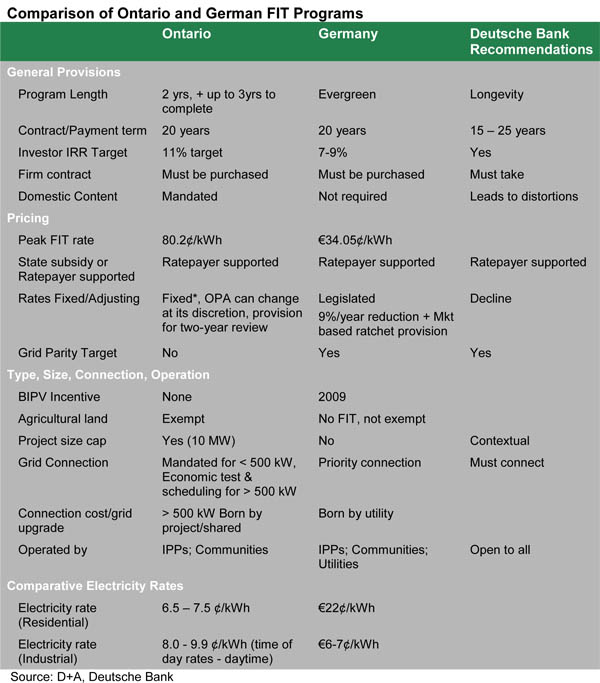

Comparing the German and Ontario programs reveals differences in program length, rate-setting and rate review, grid parity and investor IRR targets, project size cap, differential grid connection mandates, treatment of agricultural land, and, most notably, Domestic Content mandates or the lack thereof.

Ontario’s program imposes restrictions on potential FIT sites through its conditional treatment of grid connection for projects above 500 kW and the program’s exclusion of agricultural land. At the same time, the Ontario program offers high FIT rates for residential with mandated connection. Restrictive with respect to large projects, and facilitating for small, the Ontario program strongly favors residential and roof mount projects. Unfortunately, the proposed MicroFIT program change directly affects those businesses that are most focused on the Residential market, minimally causing confusion and uncertainty in that portion of the market.

Ontario’s unique Domestic Content provisions enforce the creation of a large domestic industry while moderating market forces and comparative economics. Governments have implemented FIT programs to achieve a variety of mandates including economic growth. Encouraging investment is a fundamental for generating economic growth. According to Deutsche Bank, the keys to a successful FIT program are lots of TLC; investment will be driven by FIT programs that provide Transparency, Longevity and Certainty.

The sudden loss of over 20,000 jobs following Spanish FIT policy changes was highlighted by Deutsche Bank as they observed that, “The impacts of sudden and abrupt adjustments to a FiT policy highlight the importance of sound and flexible policy design.” Based upon the Spain experience experience, Deutsche Bank identified five key areas of concern for policy makers:

1) Get prices right

2) Electricity Consumers should pay for the FiT

3) Careful cap design

4) Avoid loopholes favoring highest tariff rate

5) Market-responsive Feed-In Tariffs

Considering these five recommendations in the case of Ontario, the current MicroFIT ground mount market challenges echo three of these areas of concern:

• Getting prices right

• Inconsistencies in highest tariff rates

• Market responsiveness

Deutsche Bank encouraged Transparency, Longevity and Certainty in FIT program implementation. In Ontario, a two year mandate has created a Longevity concern – and uncertain program renewal is an inherent risk to investment. Each of these three critical factors of Transparency, Certainty and Longevity is now being tested in Ontario. Hopefully the growing pain suggested by the OPA’s Chin will be over quickly, and the continued implementation of the Ontario FIT program will preserve the jobs that have been generated and create many more.

3 Responses to “Comparing PV Feed-In-Tariff Programs from Ontario and Germany”

Trackbacks/Pingbacks

- Tweets that mention Comparing Feed-In-Tariff Programs from Ontario and Germany | d-bits -- Topsy.com - [...] This post was mentioned on Twitter by Chris Brown, Ed Gunther, and others. Just Published: Comparing #Solar #PV Feed-In-Tariff…

- Concessions and New Restrictions for Ontario’s Solar FIT Program | d-bits - [...] than being taxpayer financed, however, one of the strengths of the Ontario program is that the costs of the…

- Is the Ontario Solar FIT Program Losing Momentum? | d-bits - [...] Comparing PV Feed-In-Tariff Programs from Ontario and Germany [...]

- Ontario FIT Program Review Commences | d-bits - [...] well. When first conceived, the Ontario FIT program was highly lauded. At the time, Deutsche Bank observed that “Two…

How likely the two year trial is the learning process for OPA to formulate a more sound, efficent and long-term FIT policy? For a long-term program, it might have to employ a decreasing FIT structure to spur cost reduction over time and target grid parity just like the FIT in Germany?

Good questions.

There are two challenges.

1. Will the program be favorably reviewed – particularly against its self-imposed mandate of creating jobs?

2. Which way will the political winds blow?

The program has created headlines, interest and jobs. Whether the 50,000 jobs created goal will be achieved is really difficult for anyone to say.

There is a reasonable chance that the current Liberal provincial government, however, may not last through the next provincial election. If they do last, there has been enough momentum in the current program to provide a strong argument for its continuation. If they don’t last, the program could be in greater danger.

Cancelling a program which is creating jobs and economic benefit will be hard for anyone. Thus, the best thing that can happen is that the market continues to provide an enormously strong reception. Let’s hope that once the dust settles around the change to MicroFIT groundmount projects the market will still be excited.

I need to that I was obviously a little leary of all the so-called hype going on around solar. After considering plenty of programs and purchase options my spouse and i decide to make the leap. We wound up getting solar with no money down and then we immediatly started spending less the first month is was installed. I have to admit that this benefits associated with solar seem to be real and I am very happy we chose to move forward with it.