California - Palm Trees and Solar Forests

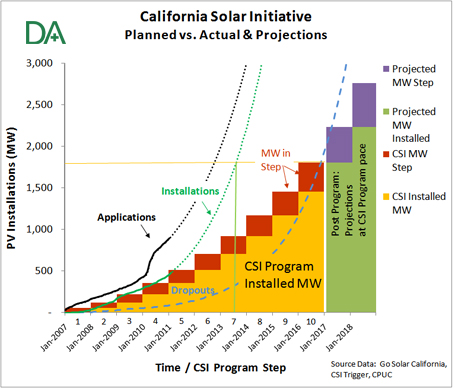

Just four years in, the California Solar Initiative (CSI) is racing ahead of its plan. The CSI PV program is already half subscribed and accelerating.

If this pace continues, the CSI PV program could be fully subscribed almost four years ahead of schedule.

Reservations now at Step 8 of 10

Originally conceived as a ten year project, with ten discrete steps, most CSI service territories are now committing reservations on Step 8 of 10.

Both the application rate and the installation rate are well ahead of plan, and 875 MW remain uncommitted from the original 1,750 MW.

Incentive structures can be tricky

Unlike the rush seen in other markets when Feed-In-Tariff incentives are due to expire, the CSI program structure is volume based and does not reward last minute activity.

CSI incentives are tied to the specific MW at each Step and the incentives decline as demand grows. Incentives started at $2.50/watt and are now down to $0.35/watt, representing roughly 4% of the typical Residential installation.

If market interest continues at the current pace, the CSI program could be completely subscribed by October 2012 if not earlier; with all of the installations complete by mid 2013 or earlier.

The CSI program is on pace to be completed at least three and a half years ahead of plan.

Program half subscribed

As of the end of January 2011, CSI capacity ‘Reservations’ had reached the 50% mark for total program availability. Actual installations are at 32%, and lag applications by about nine months.

The nine-month lag between capacity Reservations and actual installations is an interesting phenomenon – observed earlier by the Gunther Portfolio. Solar projects typically do not require a full year to construct.

High dropout rate represents unmet demand

The nine-month lag may be partially explained by the program’s ‘Dropout Rate’. Through March 31, 2010, the CSI program experienced an 18.9% dropout rate in capacity Reservations – highest for Residential reservations – up from 15% in 2008.

The dropout rate underscores that not all of the firm demand has been satisfied within the program structure. At this dropout rate, there have already been almost 40 MW worth of Residential Reservations that have not been realized. If this rate continues, that number will climb to almost 110 MW, or almost $950 million at current installation costs by the end of the program.

The growing Residential dropout volume is creating a large market opportunity unto itself. The magnitude of this opportunity is almost double the CSI capacity allocation for SDG&E Residential customers.

The California Utility Commission (CPUC) observed that reasons for dropouts include “site suitability, changing business conditions, and project financing constraints”. Meanwhile, in a comprehensive review released this past January that discussed overall Residential sector market friction, SunRun noted that, “Local permitting is the most stubborn cost that residential solar faces.”

Market friction is impeding committed customers from completing their projects. If that market friction were to be reduced, the actual market would be larger.

CSI Program Projections

What comes after the CSI program is fully subscribed?

That the CSI program is well ahead of plan is a testament to its tremendous success – especially given the built-in incentive decline. At the same time, such accelerating participation provides open question about the future of the California market.

What will happen when the CSI program has been fully subscribed? Will the California solar market suddenly come to a sudden stop? Or, will the installation rate continue at least at the same trajectory?

The rapid and increasing pace of applications and installations offers a strong vote of confidence for the future of solar in California. Tied to specific volume steps, the CSI incentives have already declined considerably. Once the program is fully subscribed there are no provisions for ongoing rebates.

Strong market endorsement

Accelerated success in the face of rapid, built-in incentive decline is a strong market endorsement.

Rather than anticipate a drop in PV demand once the CSI program is fully subscribed, it is quite possible that the market will continue to expand at least at the current pace.

One Response to “California Solar Initiative Racing Ahead of Plan”

Trackbacks/Pingbacks

- GUNTHER Portfolio twitter Weekly Updates #Solar #PV – 2011-02-12 | GUNTHER Portfolio - [...] @ddbits: Just published: "California #Solar Initiative Racing Ahead of Plan" https://d-bits.com/csi-racing-ahead/ #CSI #pv #renewables [...]

- US Residential PV Market Driven by More than Price | d-bits - [...] during this timeframe, such as the California Solar Initiative (CSI), have also helped (see: California Solar Initiative Racing Ahead…

All it took was allowing the utilities to raise the price of electricity. With higher electric rates and lower panel prices, heavy residential users can get 15-20% aftertax returns by investing in solar. Better than taxfree bonds, corp bonds, or annuities.