Cleantech is widely anticipated to be the next big wealth creation opportunity.

Cleantech is widely anticipated to be the next big wealth creation opportunity.

Oddly, however, success in Cleantech business investments has been somewhat elusive especially in the venture capital (VC) community. This paradox is true even though Cleantech has had the strong support of a mature VC industry along with motivated equity markets – albeit impacted by the Financial Crisis and global recession.

Cleantech Pillars Offer Support for Venture Development

While Cleantech may be more of a theme than an industry or sector, there are contextual commonalities. A new framework has been developed to filter Cleantech contextual elements to better separate potential winning business ventures from more marginal prospects. The Four Pillars (Four P’s) of this framework are:

Before examining these Pillars, an updated overview of Cleantech promises and the ongoing investment debate is warranted.

Huge Opportunity: The Sixth Wave

Cleantech has been hailed as the biggest wealth creation opportunity. Ever.

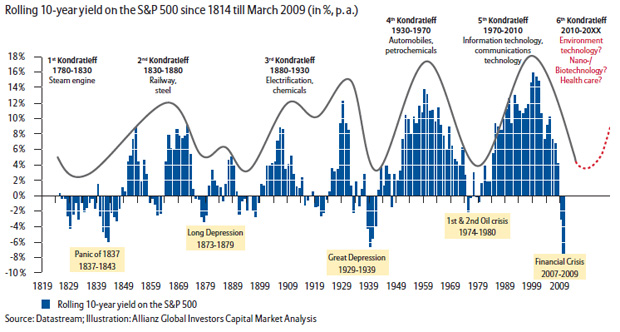

In 2008 Steven Milunovich of Merrill Lynch was one of the first to link the emergence of clean technologies to part of a larger cycle. In his report The Sixth Revolution: The Coming of Cleantech, he observed that:

“Technology revolutions occur about every 50 years. The current IT age should give way to the leadership of cleantech as the energy infrastructure moves back to renewables.”

Kondratiev Long Wave Cycles (Source: Allianz Global Investors)

Cleantech is now widely foreseen as the Sixth Wave of human innovation – following the industrial revolution, and the ages of steam & railways, steel & electricity, oil & the automobile, and information & telecommunications.

The Russian Economist Kondratiev originally described these long wave cycles in his 1925 book The Major Economic Cycles. Indicators of the end of a long-cycle include the creation and collapse of asset bubbles such as we have seen recently with the Internet and Real Estate bubbles.

Yet, unlike its predecessors, the Cleantech wave can be as much about doing the same thing, just in a more sustainable fashion.

In 2008, Sun Microsystems founder and current Kleiner, Perkins, Caufield & Byers (KPCB) partner Bill Joy stated, “We are at the point of new wealth creation when it comes to green technology.” The next year, his KPCB partner Ajit Nazre echoed “that Cleantech is the single biggest investment opportunity of the 21st century.”

In April this year, self-made billionaire and poster-child for success in the Fifth Wave’s information revolution, Ted Turner claimed that “It’s time to say goodbye to coal and oil and replace them with renewable energy – including solar, wind, and geothermal and biofuels… If I were starting a business today, that’s where I’d go.”

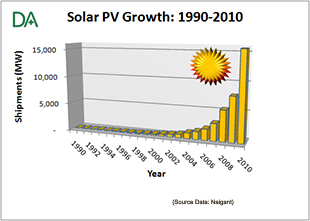

Exponential Growth in PV Industry (Data Source: Navigant)

The promise of these aspirations are already backed up by decades of staggering continuous growth in the solar PV industry; growth unlike anything seen before in any industry.

Mixed Success, Unclear Focus

Yet the venture investment track record in Cleantech thus far is at best mixed, and the term Cleantech is a broad catch-all that is neither industry nor sector. There have only been perhaps a dozen or so substantive Cleantech IPO exits after over 1,560 venture rounds and almost $13 billion worth of venture capital invested in the sector from 1995 through to mid-2010 and plenty of walking dead. In March 2009, Scott Sandell of top- tier VC firm NEA brazenly asked, “Is Cleantech Dead?”

While Sandell is a prominent Cleantech investor, there are many who remain strongly skeptical of Cleantech. Notable web investors Peter Thiel (PayPal co-founder, partner at The Founder’s Fund and Clarium Capital), and Marc Andreessen (Netscape founder & investor) have made a point of steering clear of Cleantech. As impressive as Thiel and Andreessen’s track records have been, however, the next Facebook isn’t likely to power the infrastructure requirements for the industrial revolutions taking place in China and India. Even Internet growth record holder Google is hiring solar experts and pursuing its own R&D as well as investing in Cleantech.

The overall VC industry is currently under a critical eye. Notwithstanding the successes of Thiel, Andreessen and others, there has been harsh fallout from the financial crisis and the generally poor VC fund performance since the burst of the Internet bubble. Even so, Cleantech investing has been on the upswing. Thus, the mixed Cleantech success is confounding given the strong support from a venture capital model refined over five decades as the critical enabler of the Fifth Wave: the Information Revolution.

The Information Revolution has gone increasingly viral, virtual and social (e.g. Web 2.0). Cleantech, however, is dominated by opportunities which involve material science as well as process and physical technologies.

One fundamental underlying challenge in Cleantech investing is that Cleantech itself is more of a theme than an industry or even a sector. Fortunately, there do appear to be common business challenges within the theme. The majority of current Cleantech opportunities involve the manufacture of tangible goods delivered through comprehensive supply channels. At this early stage of the Sixth Wave, and arguably by its nature, Cleantech is infrastructure focused.

Many models have been constructed to evaluate potential venture investments – and to finance and develop them successfully. With a low success rate within Cleantech, however, these guidelines themselves, while valid, appear to require further foundation.

As Cleantech VC firm @Ventures observed, “VCs need to stop trying to figure out what new investment models work in Cleantech. They need to start figuring out what parts of Cleantech work for the proven VC model.” Asked another way: Through what additional lens can we evaluate Cleantech opportunities in order to succeed with conventional venture development models?

The Four Pillar Framework of Plant, Process, Phase and Policy offers a base of support for the classic Venture Capital model to separate potential winners from marginal prospects.

Consumerism Yields to Empire Building in the East, Rebuilding in the West

In contrast to software investment trends, Cleantech investing at this point is more consistent with a VC investment model of the past. Consistent with basic infrastructure developments common in the early part of a Kondratiev long wave, early Venture Capital investments backed physical products, processes and manufacturing.

Indeed, the first ever Venture Capital start-up investment was for Fairchild Semiconductor who produced the first commercial integrated circuit. The business models that launched the semiconductor industry arguably has more in common with solar cell manufacturers than with today’s social media companies.

- Will Consumerism yield to Infrastructure or remain perched atop it?

Growth Consultant and Author David Thomson (Blueprint to a Billion: 7 Essentials to Achieve Exponential Growth) recently observed that we are moving from a consumption-driven eight-year business cycle to an infrastructure-driven business cycle. Thomson’s insights were echoed at the start of October by Lawrence Summers, the departing director of the National Economic Council who stated, “the United States consumer (cannot be) the single engine of global economic growth.” Such a transition in the shorter-term business cycle to an infrastructure-driven economy is thus aligned with and arguably may accelerate the long wave transition from the Fifth Wave to the Sixth.

The Four P’s: Plant, Process, Phase and Policy

There are two inner Pillars – Plant and Process – and two outer Pillars – Policy and Phase.

With respect to the inner pillar, Process, there have been many suggestions that Cleantech development cycles may, of necessity, be longer than those for information technology. Yet the Venture Capital industry gave birth to the semiconductor industry – an industry that can make rocket science look easy.

There is no inherent reason why Cleantech Process development should be out of sync with other technology development practices. In fact, Cleantech can learn and leverage much from short, iterative software Process development that integrates customer-driven input with rapid product refinement.

Cleantech’s dominant association with infrastructure underscores the inner Cleantech Pillar of Plant.

Plant refers to manufacturing plants as well as all of the public and private infrastructure, the physical markets for physical goods and the associated material and equipment supply chains.

Energy, the core of Cleantech, and its transmission and distribution represents some of mankind’s greatest infrastructure creations. The replacement cost of aging power transformers alone in the North American grid is estimated to be in excess of $200 billion. At the same time, though, the 3,100 or so US electric utilities are estimated to produce close to 40 percent of the world’s greenhouse gases.

Problem – greenhouse gas emissions – meet opportunity – massive aging infrastructure!

A fix to the electric grid, however, is not so easy to implement.

Flanking the Cleantech Pillars of Plant and Process, we have the contextual Pillars of Policy and Phase.

Commenting on the US energy policy and the regulatory framework, GE’s CEO Jeffrey Immelt recently stated that “What we have today (in the US) is stupid.” While the US policy framework may be a structural impediment, Germany’s Feed-in-Tariff innovation has been an enabling catalyst for clean energy. In this blunt statement, Immelt underscored the importance of the Cleantech Pillar Policy.

Governmental regulation and overall Policy is critical to enabling many Cleantech opportunities. Local Policy can have tremendous enabling and restrictive influences on global Cleantech opportunities.

The final Pillar, Phase, refers to Industry life-cycles: What is the life-cycle of the target industry and how accessible is the addressable market? While other models – such as Porter’s Five Forces – are commonly used to characterize a single industry, Cleantech opportunities are spread across many, typically aging, industries. Many of the largest Cleantech targets are in industries that have entered the maturity or decline Phase.

The latter stages of an industry life-cycle are more associated with commoditization and marginal differentiation than they are with high adaptation or rapid adoption of outside technologies. There may be widely recognized problems and opportunities – even by the existing industry players –but whole industries in this Phase may be slow or structurally restricted from reacting.

Challenges related to industry Phase can be compounded by Policy. This is particularly true when mature or declining industries also have regulatory hurdles to new technology adoption. Thus, while an industry’s problem may be huge and well accepted, the target industry’s life-cycle Phase may create structural impediments to rapid uptake of new Cleantech advancements.

There are a number of strategies for dealing with issues of Phase. If adoption intransigence from existing players cannot be overcome, it may be necessary to actually build out sub-sector ecosystems.

Each of these Four Pillars of Cleantech Context will be examined more closely in follow up posts.

Updated November 7, 2010

10 Responses to “Introducing a New Cleantech Assessment Framework”

Trackbacks/Pingbacks

- Tweets that mention Introducing a New Cleantech Assessment Framework | d-bits -- Topsy.com - [...] This post was mentioned on Twitter: New d-bits article - "Introducing a New Cleantech Assessment Framework" http://bit.ly/9K0Tpg #in [...]

- Tweets that mention Introducing a New Cleantech Assessment Framework | d-bits -- Topsy.com - [...] This post was mentioned on Twitter by Lynn Anne Miller. Lynn Anne Miller said: READ THIS! RT @ddbits A…

- The Cleantech Pillars - Plant | d-bits - [...] Cleantech Pillars framework is a new assessment tool for Cleantech [...]

This is a fascinating post, thank you so much. I come at this debate as someone relatively new to the cleantech “sector,” yet with much experience in the vc funded realms of software and semiconductors, which you refer to in your post. (Ex Telogy Networks and TI). And as a marketer, my “4Ps” are different than yours!

Nevertheless, I’d like to just bring up two points that perhaps you could explore in future posts.

1. A few weeks ago I attended the Georgetown Energy Conference. It was a fabulous event, with many leaders from the energy sector on the panels, speaking to an audience comprised primarily of Georgetown MBAs and alums (Hoya Saxa!) The panelists were uniformly SKEPTICAL of renewables. There was a definite friction between their viewpoint and that of the students, although it was not openly expressed in the sessions, but rather afterwards in the informal networking. A major reason for the skepticism on the part of the panelists is that the cost of natural gas is decreasing and in fact is making the economic viability of some of the cleantech investments (particularly solar) questionable.

2. To your point about impediments to rapid uptake of cleantech investments, I say this. There needs to be a bridge built between consumer DEMAND and cleantech investment. At the Georgetown conference, as well as a recent Brookings Institution session I attended, the role of consumer pull was completely overlooked. Typically at these sessions you see panels of aging men talking in bureaucratic-speak about “driving consumer change.” Well, the consumers – driven by women (particularly mothers, the agents of change throughout history) are DEMANDING cleaner fuels and other energy technologies.

And now for my brazen pitch – forgive me – but if anyone reading this is in a position to make consumer marketing investments in cleantech, please, please please contact me. I can help you to build that bridge between consumers and the technology. Consumer behavior changes start at home. Mothers are in control. Kids are demanding it – check out my former client GreenMyParents to see an amazing example of this phenomenon. We can make cleantech our next Moon Shot. The activists, consumers, and marketers are ready. The energy companies have the resources to make this happen. But the two sides are not connecting on this issue. This is what we need to move cleantech forward.

Thanks for the comment!

Your points are well taken, and the additional insights appreciated. I am definitely aware of the Marketing P’s. Working with these four pillars, P worked better than the rest of the alphabet – Policy being the clincher.

I will talk more about conventional marketing as applied, or not, to Cleantech. There are much more significant channel (Marketing Mix: Place) considerations in most Cleantech situations than IT at this point.

Also, when it comes to the 4th Pillar – Policy – not only are many Cleantech markets regulated, but are at the intersection of Government funding and regulatory policy.

As with the solar market in Spain, the impact can literally be binary.

Thanks for the brazen pitch. If you come from IT, then you are well-versed in challenges of technology push versus market pull. Again, with the strong influence of ‘Policy’ in Cleantech the need for marketing can be overlooked. In fact, with emphasis on building infrastructure (“Plant”) and concern over cash requirements, marketing can be purposefully underfunded.

Very interesting post.

One thing that struck me, however, is that the Cleantech investor is really looking at a developing set of technologies that is supposed to supplant the existing source / technologies available for energy generation.

While the need for a plant and process is different for Cleantech than information related tech – the comparison to infrastructure development is not necessarily better. Information technologies were generating demand where no alternative existed. They were not in an environment where you needed to displace the growth of conventional technologies (driven by the demands of a mature market!) – and perhaps even seek to displace it.

I’m not sure we ever seen this historically. Sure horses were replaced by cars for travel but that was because cars offered a new level of convenience and didn’t need to constantly feed on grain or have their stalls cleaned out regularly.

You can’t ‘see’ much difference in the electricity generated by PV.

To W’s point about not “seeing” much difference with PV, take a look at a few of the interesting “consumer champion” campaigns being run by solar companies. They’ve got their customers out on YouTube and elsewhere talking about what heroes they are for purchasing solar power vs. conventional. No, you can’t “see” a difference in the end product – power – but again, it’s the opportunity to use renewable energy as a bridge to the growing number of environmentally concerned consumers.

And David, yes, thank you for your response. And of course I knew that you knew the 4Ps! I think you may have even been at HBS with some of my friends.

LOL – learning things like the 4 P’s doesn’t necessarily mean that I remember them!

My sense is that we all feel that the energy revolution is going to be tremendous and, as Lynn rightfully point out, it is driven by concern for the environment.

But this is where things get tricky.

‘Environmental concern’ is really about what we don’t want. We don’t want polluted air, rivers or lands. We don’t want our children living with our ill-advised, greed-driven choices for growth at any cost.

However, ‘concern’ is not true demand. That can only be generated when a solution presents itself that will address those concerns. Such a solution has to promise /prove that it will make the world a better place.

This is a tall order not likely filled by a single solution but by many each addressing one or more of the many facets of this social/environment/economic puzzle we find ourselves in.

And, this is confusing. How are all these technologies going to work together? Do we need all of them? Which ones are the best? All these questions defuse demand –but thankfully not the underlying concern.

W

Very insightful post. I don’t think Cleantech industries are going to go anywhere until the proponents can show some actual progress.

Windmills operating at 10%, blighting the landscape and killing birds is not progress. It only stiffens resistance to workable systems.

Technologies that require subsidies have a short time frame to prove their worth. I haven’t seen anything in the energy side of Cleantech that has enough promise to make it over the “subsidy canyon”.

M

Thanks Murray.

Like you, I believe that sustainability includes a value proposition that can stand on its own merits. Subsidizing new technologies is not restricted to Cleantech. Government R&D funding is a critical tech sector enabler.

In terms of fundamental cost of electricity, both solar and wind have made incredible strides. At their current pace, it is actually not that far off where either will be past the grid parity barrier – and will represent the best economic alternative. When I first entered Cleantech fifteen years ago it didn’t appear that either alternative had much chance of this. Today, though, the progress has been nothing short of astounding.

To get to where they are now they have both been outsiders with respect to the incredible amount of ongoing subsidy to fossil fuels (e.g. coal and nuclear) and nuclear, for example.

It unfortunately isn’t a level playing field. This is not an excuse for filling the subsidy canyon with public money, but it would be helpful if there were a more level playing field with respect to subsidies for the conventional alternatives. We are also looking backwards. The costs to install the prevous generating capacity in North America is not the same as installing new generating or transmission capacity – and our grid is increasingly strained.

Meanwhile, costs are dropping for PV installations arguably faster than some governments can react to reduce or remove tariff subsidies. Those subsidies appear to have provided the desired result. And, in the case of Germany, for example, at costs that are barely noticable to electricity consumers.

To get a nuclear plant permitted can take a decade or more. Moreover, when a nuclear plant is ‘decommissioned’ it is still staffed – forever. With solar, 100’s of MW can be installed in months and almost all components can be fully recycled. Unfortunately these types of cost advantage are not factored in.

Another example of hidden costs and understated value is in respect to readily available clean water.

It would be great if new Cleantech alternatives required no subsidization to achieve the scale and costed out production capacity to compete with current practices. Then again, it would be great if my tax dollars weren’t supporting the conventional alternatives either.

Until we change the very nature of public infrastructure and regulated utilities, providing some degree of subsidization to steer towards a more sustainable outcome seems justifiable.

I am glad to hear the costs are dropping so quickly – it escaped my notice. At this rate, they are sure to be economic on their own terms without need for subsidy. Progress leads to progress.

So yes, let’s do our best to remove current subsidies on other generation methods and let the free market work.

Hi Murray,

Updated figures on energy subsidies – fossil fuels and renewables – have just been released by the IEA in their World Energy Outlook 2010.

https://d-bits.com/world-energy-outlook-2010/