The Solar Universe is Small

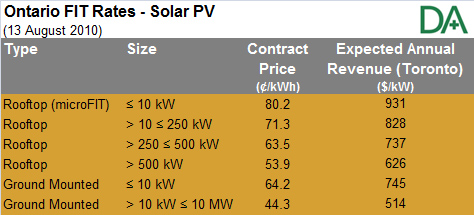

The Ontario Power Authority (OPA) shocked the nascent Ontario PV industry on July 2 with plans to cut the tariff rate on small solar PV ground-mount systems by 27%, from 80.2 ¢/kWh to 58.8 ¢/kWh.

New Eligibility Criteria

Yesterday, August 25, as a follow-up to the finalized rate changes announced on August 13, the OPA provided a series of documents outlining New criteria developed to better define microFIT Program eligibility along with changes to the Feed-in-Tariff program microFIT rules that incorporate the eligibility criteria.

Prior to the July 2 proposed rate cut, the Ontario solar PV Feed-in-Tariff program had received high praise from around the globe. Admittedly, though, there had long been angst expressed within the PV industry about the program’s relatively high tariff rates and the risk of rate changes on short-notice. Market stability through FIT program consistency is a critical factor for the capital intense PV industry.

As noted in previous d-bits posts, initial reactions to the surprise change were harsh (e.g. Ottawa Business Journal: Solar installers fume over rate reduction, National Post: Ontario solar program in disarray). Comments like that of David Watts of Solera Sustainable Energies, as quoted by Tyler Hamilton of the Toronto Star (Clouds over Ontario solar plan), who observed, “It has shaken investment in Ontario to the core,” were common. The National Farmers Union demanded that the OPA abandon the rate change.

Support from the Opposition

Ironically, some of the political heat directed at the ruling Liberal Party over the proposed change may actually turn out to be in the best long-term interest of the FIT Program. Perhaps surprisingly, opposition members were championing the government’s program to criticize the government on the proposed rate changes. One significant industry concern over the Ontario FIT program is related to its longevity prospects. The two year program is scheduled to expire exactly one week before the 2011 Ontario Provincial election. The fate of the FIT Program’s renewal – and any and all of the jobs it generates – may hinge on the outcome of that election.

Reacting to voter concerns, however, the oft-outspoken Progressive Conservative Party member Bill Murdoch, who represents the 2007 election swing riding of Bruce-Grey-Owen Sound, effectively endorsed both the FIT program and its tariff rates when he spoke out against the rate cut. Murdoch was quoted by The Globe and Mail as stating that many farmers who have invested up to $100,000 in solar technology are going to be hurt by the reduction. An article by Nicole Million quoted Murdoch’s Fellow Progressive Conservative MPP Garfield Dunlop advising that the decision will hurt the Liberals in rural ridings come election time

Should Murdoch’s and Dunlop’s Progressive Conservative party share their views, a change in provincial government may not represent a risk to the FIT program.

We have thus had the Minister in charge, Brad Duguid, openly criticizing his own program while opposition members were championing it. These are indeed strange times in Ontario.

Final Rate Cut Includes Concessions

When the rate cut was finalized on August 13, the OPA made concessions while acknowledging the extensive feedback it had received that provided the OPA with the impetus to settle on a higher tariff rate than originally proposed. The final rate cut was rounded off by an arbitrary appearing 20% drop to 64.2 ¢/kWh. With the reduced magnitude of the cut, there was some initial expression of relief – and some well-earned expressions of accomplishment from the likes of CanSIA (Canadian Solar Industry Association) who had lobbied hard against the cut.

A bit shaken and stirred, the Ontario industry appears to be thankful for the opportunity to live twice given the last minute OPA concessions. In his Clean Break blog, Tyler Hamilton suggested that “Showing a willingness to listen and change direction restores confidence in the process and the program”. But has full confidence truly been restored? Looking more broadly, what are industry experts and analysts saying?

On this point, the highly regarded Lux Research is now more openly skeptical about the Ontario PV industry. In an August 19 newsletter to its clients, Lux cautioned that “clients should expect this announcement to foreshadow further cuts before the end of the year… While Ontario may remain a solid solar market at more reasonable FIT rates, the gold rush there should be drawing to a close.”

These concerns are consistent with an August 17 Electric Light and Power article by Julia Komitova. Komitova stated that “Despite the softened cut, challenges before Ontario’s renewable energy remain and the bonanza may face a rocky ride to continue.”

Komitova went on to observe that “Although it affects a small segment of the market, the reduction rippled beyond homeowners, farmers and small businesses that the microFIT scheme was designed for, stoking market insecurity for both equipment suppliers and investors.”

Financing Needs Remain Critical

The FIT program’s Domestic Content provisions were designed to foster manufacturing investment and create Ontario jobs. While there has been success as evidenced by recent announcements, and module manufacturing capacity aspirations in excess of 1 GW, Ontario still lacks domestic participation from a ‘bankable’ module manufacturer – the most leveraged PV manufacturing step under Domestic Content guidelines. The PV industry’s mainstream module manufacturers have not announced plans to establish themselves in Ontario. In fact, a strong lobby effort is apparently continuing to pressure the Ontario government to reduce Domestic Content requirements.

Without ‘Bankable’ products, lenders are reluctant to participate. Financing may yet be the Achilles heel of the Ontario FIT program. Along with the rate cut, the OPA also provided new participant restrictions – barring ‘Commercial Aggregators’ from participation in the microFIT program. While these participants may have been looking at higher returns than anticipated by the program’s designers, financing is ultimately critical to the overall program success.

Justin Woodward, EVP of project finance firm JCM Capital advised d-bits that “Though progress is being made, the demand for financing solar projects in the province remains significant as Canadian debt and equity providers are relatively new to the market and expect much higher rates of return and lower risk profiles than their European counterparts.”

Thus, in Komitova’s words, a significant challenge for Ontario may yet be that “Banks are also reluctant to lend the billions needed to build wind and solar farms as long as provincial rules dictate that a project’s contract can be terminated once it is fully built if its local-content input falls short.”

The Domestic Content issue continues to be a key wrinkle. Let’s hope that money begins to flow into Ontario projects, and soon.

One Response to “Reactions to Ontario’s Solar FIT Program Changes”

So according to the fit revenue chart in this article the big mulinational retail chains and multinational solar companies will receive 2700 ($kW) of revenue (anything over a 10kW project)and the small home owners here in Ontario will receive 1676 ($kW)of revenue.

It is obvious any projects over 10kW are being done by the large publicly traded retailers (such as the lage grocery retailers) who have large buildings and by solar companies like “First Solar” who manufacture their own panels out of the country for $.73/Watt. If you check the FIT website and visit the awarded projects section you will see all the mulinationals that have applied and you will notice very few small individual businesses applying for over 10kW. Where do you think the average Ontario home owners plans to spend his profits from the FIT revenue? Yes, in Ontario! Therefore why would you lower rates on the home owner part of the program when these are the very people that will spend their profits back into Ontario. Do you really think First Solar plans on spending their large profits from their massive solar farms in Sarnia back into the Ontario economy? This program is so flawed and I can’t believe the media hasn’t ran any articles on how most of the profits are being directed out of Ontario. Mean while every Ontario home owner is going to continue to pay more for hydro to support this program of shipping our hard earned money out of the country all thanks to Dopy McGuinty