Two weeks ago, Fred Wilson of Union Square Ventures proposed that There are Two Venture Capital Industries – one that funds Software and one that funds Cleantech and Biotech. Fred’s observations have already provoked a number of interesting responses from Rob Day, Erick Schonfeld, Paul Kedrosky, Jeff Busgang, Duncan Davidson and CB Insights among others.

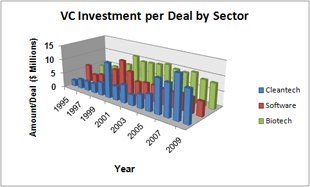

This divergence is underscored by trends on venture capital deal size between these sectors (source data: PriceWaterhouseCooper/NVCA’s MoneyTree database).

The difference in deal size between these three sectors over the past ten years is striking. On average, software Venture Capital deals are now roughly half the size of biotech or Cleantech deals.

The difference in deal size between these three sectors over the past ten years is striking. On average, software Venture Capital deals are now roughly half the size of biotech or Cleantech deals.

Biotech deals, of course, have long been singled out as expensive due to their extensive trials and long and arduous regulatory approval processes prior to revenue generation. The separation trend between Cleantech and software deals is more recent and not as easily explained.

There appears to be at least four possible explanations for this trend:

- Transition from dot-com bust to Cleantech boom

- Follow-on rounds emphasis versus initial rounds

- Improved software development efficiency

- Cleantech is a new experience

1. Flight from the dot-bust

It would be hard to argue that attention did not shift away from the software sector after the Internet bust. Thus, one factor propelling Cleantech deal size may have been the initial success in raising Cleantech funds – particularly in the wake of reduced interest in Internet related options.

A flight from dot- busts to Cleantech hope may have been a contributing factor to deal size in the early 2000’s, but the difference in deal size ratio has been maintained through 2009. The dot-bomb, as dramatic as it was, does not appear to be the fundamental rationale for the deal size differential between Cleantech and software.

2. Portfolio life-support

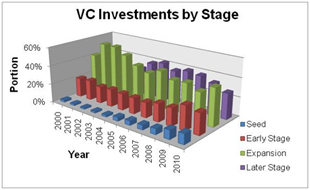

Follow-on rounds, by their nature, are larger than initial rounds.

The lack of IPO options in combination with severely impacted debt markets has reduced liquidity options for VCs. Potential portfolio winners still need life-support in order to salvage hope for fund LP returns, however, even if portfolios are rationalized. Thus, another possible explanation for the round size differential could be VCs were preferentially supporting their existing portfolios with follow-on rounds versus new deals.

While this trend appears intuitive, the information in the NVCA database actually suggests the opposite trend.

Throughout the last decade, earlier stage deals have received an increasingly higher portion of overall funding than later stage. Moreover, roughly 60% or more of ‘First Sequence’ investments were in Seed or Early Stage rounds.

3. Software development productivity

In at least one area – new software development – the IT revolution may have finally solved the productivity paradox.

“You can see the computer age everywhere but in the productivity statistics.” Robert Solow, Nobel Prize Winner

If we have solved the Paradox, there may yet be hope for addressing software bloat!

In his post on the splitting of the VC industry, Fred Wilson also offered the insight that, “The software VC business has been fundamentally altered by the massive decrease in the cost of building and launching a software business.”

Such improved capital efficiency phenomenon may also reflect the fact that we are now at the tail of the Fifth Wave: The Information Revolution. Disruptive Innovation guru Clayton Christensen noted that disruptive opportunities occur at the tail end of technology cycles when new capabilities can be developed faster than the evolution of market need.

Said another way, as technology matures we become more efficient in developing new functionality, features and capabilities. The reduced costs of building and launching a software business could be reflection that software is now a mature industry.

4. Cleantech is a new experience

Steven Milunovich of Merrill Lynch was one of the first to propose that humankind is now transitioning from the telecommunication and information revolution to the age of Cleantech

While the IT revolution brought us new industries such as software and semiconductors, Cleantech does not have the benefit of an industrial or a sectoral focus. At best, Cleantech is a broad theme rather than a narrow focus – notwithstanding what certain TV commentators may suggest.

If we are at the start of a new wave of innovation, then there are a few things we can look forward to. Early bets can provide large returns, and Cleantech businesses will get more efficient.

Perhaps the difference in deal size is at least partially due to the experience curve.

4 Responses to “Is the Venture Capital Industry Splitting?”

Trackbacks/Pingbacks

- Tweets that mention Is the Venture Capital Industry Splitting? | d-bits -- Topsy.com - [...] This post was mentioned on Twitter: Just published on d-bits Is the Venture Capital Industry Splitting? https://d-bits.com/is-venture-capital-splitting/ #vc #startup…

I would add a 5th, the polarization of fund size and the business and investment models associated with them. Cleantech offers the ability to deploy large amounts of capital in less risky investments due to their asset intensiveness and lower expected rates of return. Return enhancement occurs within the capital structure using techniques more frequently seen in the private equity space. Hence large funds operate more like private equity funds and gravitate towards cleantech. Smaller funds don’t have the luxury of significant capital tend to gravitate towards software and smaller deal sizes, looking instead to enhance returns through the optionality of shorter time to realizations.

Thanks Eric. Insightful point and well-stated.

Perhaps a part of this same phenomenon could be those large funds that can pursue a ‘portfolio’ approach with many small bets in Internet-related situations. Such approaches being less available in Cleantech.

Thanks for that, and keep up the good work.

Venture capital can be very profitable if you can handle all the pressure. ..