With a little help from Cleantech, Lux Research and d-bits, Cashivore has officially entered the modern lexicon. As of the end of November, Urban Dictionary now includes the following definition.

With a little help from Cleantech, Lux Research and d-bits, Cashivore has officially entered the modern lexicon. As of the end of November, Urban Dictionary now includes the following definition.

Cashivore /kæʃ ɪ,vɔ:(r)/ n. 1 a a money-eating or cash-devouring enterprise, person or project. b a person, project or company that continues to consume large amounts of cash with no end in sight. 2 a person that only eats if paid to do so.

The Billion Dollar Club

There are at least five venture investments that have reached the Billionaire club. Individual VC-backed companies thus now rival the size of the largest VC funds as well as the GDP of at least 18 different countries. Reaching the billion dollar mark doesn’t necessarily make these or other investments a Cashivore, but this is a tremendous amount of venture stage capital by anyone’s accounting.

The feeding – or spending – frenzy may not end here. Hot on their heels, at least one Cleantech venture has projected a need to raise $500m in their next round of financing. Apparently, that half a ‘Bill is considered mere pocket change and will be used to achieve their first full-scale prototype.

With that kind of coin for a first prototype, how much will the beta trial cost? What about the investment needs to bring the prototype into full production?

Providing some further Cashivore context, while the first Billion dollar Venture Capital fund was launched 24 years ago there are currently only five VC funds greater than a billion dollars.

Of the five billionaire investments, three are in Cleantech. Some investors and pundits have suggested that Cleantech is inherently expensive. Others have observed a VC tendency to push for a higher cash burn model, possibly following trends from the IT bubble, with the expectation that more money can speed development and buy larger exits.

Either way, without correction, continued pursuit of Cashivores runs the danger of mass extinction. The VC industry still reeling from the effects of the recent recession. Feeding the Cashivore may only reinforce predictions that the VC industry may never return to its previous size.

It’s not rocket science… but costs as much or more

Single Cleantech shots now rival the cost of a Lunar Module and approach the entire, inflation adjusted Mercury Space Program (The Mercury Program and its 26 manned and unmanned flights cost $384 million, or roughly $2.9 billion in 2010 dollars).

When JFK boldly launched the race to the moon, that goal was achieved in just over eight years. The clarity of this goal helped catalyze the corporate world’s adoption of the Mission statement as a fundamental part of strategic planning.

Thanks to JFK’s clear Mission, mankind’s greatest achievement was accomplished in the timeframe of a ten-year venture fund. The same cannot be said for some of these Cleantech deals.

Cleantech does have plenty of opportunity. If venture capital is indeed in decline, unless the trend to feed the Cashivore is corrected, many great opportunities may be lucky to get post meal scraps from the Cashivores.

Running from the Cashivores

Gigantism - Giant Bulldog Bear

Black Coral Capital’s Rob Day outlined four expected reactions to this initial phase of Cleantech investment:

- Continue to beat your head against the wall

- Narrow your view of Cleantech

- Abandon the category (run)

- Invent new approaches

Number two on this list – Narrow your view of Cleantech – appears to be the current in vogue response.

‘Energy Efficiency’, for example, has been cited by Dallas Kachan as the emerging rock star of Cleantech. This was echoed by Battery Ventures who foresee 2011: The Year of Energy Efficiency.

Energy Efficiency alone, however, is a subset of the opportunities available in Cleantech. This does not mean that Energy Efficiency investments should be discouraged. Cleantech investors are due some success. Returns on Energy Efficiency investments could help stimulate generate an inflow of financing to help lift other Cleantech sectors.

New guidelines for success

Consistent with Day’s view, the Cleantech Pillars provide new guidance on the pivotal Cleantech criteria of Policy, Plant, Process and Phase.

Policy and Phase are market contextual, while Plant and Process are venture selectable and manageable.

All four Pillars influence venture selection, strategy and management hiring decisions. Though the Pillars framework itself is a new invention, the concepts embody lessons learned from IT and manufacturing sector successes.

NASA’s original Mercury Program guidelines, for example, may have some applicability for Cleantech ventures:

- Existing technology and off-the-shelf equipment should be used wherever practical.

- The simplest and most reliable approach to system design would be followed.

- An existing launch vehicle would be employed to place the spacecraft into orbit.

- A progressive and logical test program would be conducted.

These original Mercury program guidelines suggest that rocket science may not be that complicated after all. Minimally, they reinforce the need for a pragmatic approach to contain technology risk and mitigate capital intensity.

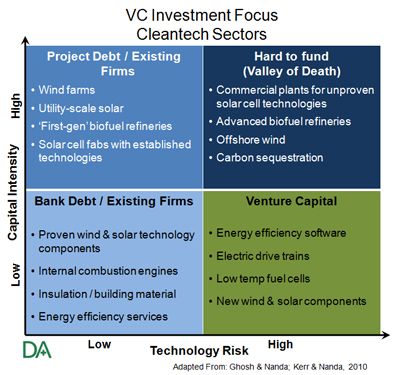

In fact, these guidelines are effectively represented by the VC Cleantech Investment Focus matrix as adapted from Gosh and Nanda and provided in The Cleantech Pillars: Process.

If the bulk of the VC community pursues Energy Efficiency, there may be many bargains to be found in other Cleantech sectors. Certainly the tremendous growth in solar, for example, must minimally yield opportunity as a derivative of the rapid rate of industry change.

The Cleantech Pillars can help identify potential winners and avoid the perils of insatiable Cashivores.