In his keynote address at PV American yesterday, the Solar Energy Industry Association’s Rhone Resch observed that Solar is now the number one growth industry in the United States.

Market data from the DOE’s Tracking the Sun III backs him up.

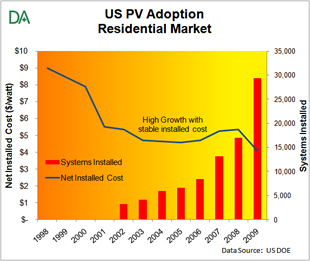

Released at the end of 2010, this DOE report reveals that between 2002 and 2009 the residential solar PV market alone grew tenfold. The residential market grew at an average growth rate of over 40% per year to $1.1 billion by 2009. It then posted another 68% growth in 2010.

Perspective from other markets

To put this market growth in perspective, when CD sales were growing by 25% per year back in 1994, that market was described as ‘explosive’.

In more of a direct comparison, according to BusinessWeek DVD sales growth dropped from 29% in 2004, to 9% in 2005 and 4% in 2006. Meanwhile, residential solar outgrew the DVD market substantially at 40%, 15% and 31% respectfully and by 2010 had passed it in overall size.

Not driven by price

Counter to conventional wisdom, the most profound takeaway from this market data is that price declines did not contribute to the high US residential PV market growth over the past eight years. Eric Wesoff at Greentech Media, for example, recently provided an excellent article on “What Really Motivates Consumers to Install Residential Solar?” Wesoff provided the results of a recent market survey on consumer attitudes that underscored concerns on affordability.

Apparently, though, at least one critical installed cost level has been reached.

The new support programs introduced during this timeframe, such as the California Solar Initiative (CSI), have also helped (see: California Solar Initiative Racing Ahead of Plan). As outlined in the Wesoff article, factors beyond subsidies, such as awareness promotion, customer perception, service and an easier application process also contribute to market growth.

The CSI program is exhibiting breakout success. Yet if all of the CSI related residential installations were subtracted from the US market data totals, the US residential PV market still posted a remarkable 31% average growth rate between 2002 and 2009.

Installed costs did finally decline appreciably between 2008 and 2009. The continued growth trend from the previous six years, however, could have accounted for over 80% of the 2008 to 2009 growth. The success factors were already in place before the drop in installation costs.

Solarbuzz Module Price Trends

Component costs declined, but so did subsidies

Market reporting firm Solarbuzz has documented the decades-long price decline for key components such as PV modules and inverters.

Where module pricing was relatively stable, the costs of all components declined by 22% during the 2002-2008 period. Subsidies, however, declined by 44%. The declining costs and declining subsides balanced each other out, net installed cost remained virtually constant.

The 2008 installed cost was just $0.01/kW below that of 2002. Per system costs actually increased during this period as the average system size grew by 5%.

Growth defies financial crisis

Astonishing given the fact that the majority of market relies on home equity lines and/or new credit facilities to purchase PV systems

Given that this timeframe bridged the housing crisis, the market growth is a phenomenal achievement. The majority of residential systems installed during this period were financed by the homeowners directly. Only 13% of CSI residential systems, for example, are third party owned.

Bridging the financial crisis, the US PV market reflected price inelasticity and even inverse elasticity (an increase in demand when prices rise).

US residential PV has been a recession proof market.

Market threshold price versus market clearing price

It is widely accepted that solar PV must meet a price of electricity comparable to the electric grid in order to achieve broad market acceptance. In the PV industry, this clearing price concept is known as ‘grid parity’. While component costs are dropping quickly, this level has not yet been reached. How then to explain the exponential market growth?

The average installed price per kW between 2002 and 2008 was $4.94/kW installed, and above grid parity for most US markets. At average US residential electricity pricing, this installed cost would require between 20 and 30 years to fully recover these installed costs.

What the residential PV market data suggests is that the $5/watt level may represent a market threshold price for residential PV in the US. Notably, some recent US residential installations are now achieving $5/watt before the benefit of subsidies.

The market data underscores that absolute grid parity is apparently not fundamentally required – in the residential market – in order to stimulate strong demand. This market threshold price response also confirms that other factors beyond simple economics are at play. Reaching nominal economic return (e.g. 20 to 30 years) appears to be an initial and powerful market acceptance threshold.

There are a lot of things going right in the US residential PV market.

2 Responses to “US Residential PV Market Driven by More than Price”

Where did the data for your first chart come from? The report you quote (http://eetd.lbl.gov/ea/emp/reports/lbnl-4121e.pdf , page 10) says installed cost of about $10 per Watt in 2002 (included all systems, not just residential), while your chart shows something like $5.50 per Watt for “net installed cost.” What is “net installed cost?”

And how do you figure that “the average installed price per kW between 2002 and 2008 was $4.94/kW installed?”

Also note that the median installed cost for residential systems in CA, before incentives, was about $8 per Watt in 2008 per CSI data (systems 10KW or less).

The Solar “industry” is obviously not an industry. It is entirely dependent on handouts by the taxpayer, so it is a charity designed to enrich certain people, including Mr. Resch. CD sales were not subsidized by the taxpayer.

Hi ECD Fan,

Your numbers are correct. Your numbers, however, are the total installed cost and do not incorporate the impact of any subsidies.

The numbers I cited are for the ‘Net Installed Costs’. In other words, the installed costs net of any federal, state and utility subsidies.

These Net Installed Costs are lower than the total cost. The numbers cited in the article above are extracted from the data tables behind the report.

From page 3 of the report (5th page in the pdf):

“In 2009, the average net installed cost faced by PV system owners – that is, installed cost

minus after-tax incentives – stood at $4.1/W for residential PV and $4.0/W for commercial

PV.”

While the cap on the Federal ITC was lifted in 2009, and installed costs dropped, the observations provided above still hold. The net installed price was flat to unchanged between 2002 and 2008. Meanwhile, demand increased geometrically.

Chapter 4 of the report starting on page 27 provides a detailed discussion of “Net Installed Cost”. Figure 22 on page 30 outlines the decline in total average incentives from a peak in 2002 to its lowest level in 2008.

With respect to whether solar is an industry or not, perhaps you are questioning its viability and its ability to exist without subsidy rather than its actual existence.

Whether you agree with the existence of subsidies, or their magnitude, the industy does exist.

The purchasing trend observed in the US residential solar market underscores that substantial and growing demand exists at an equivalent commercial price of ~$5/watt. Based upon demonstrated purchase behavior, this represents a viable price threshold. Should the industry be able to sustain pricing at these levels, there would be growing demand without any subsidy.

Regards, David