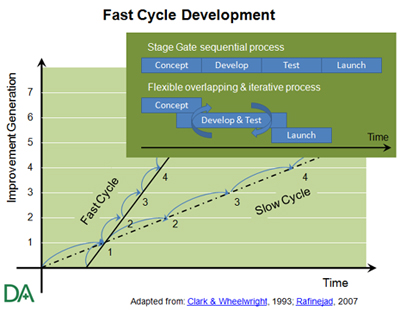

The need to stay market focused in technology development and get products quickly into customer hands translates to the Pillar of Process.

Market requirements, corporate direction and technology options can all change quickly and must be tightly integrated with the development Process. For a new venture, the ability to predict market conditions is limited at best. Thus, rapid new product and process development provides higher likelihood of Cleantech business success.

This may be a familiar refrain for those familiar with venturing in information technology (IT). Many Cleantech business opportunities, however, rely on physical products that leverage fundamental materials science. Where the dominant IT manufacturing strategy for the past decade has been outsourcing, manufacturing Process capability is integral to the success of many Cleantech opportunities.

All too often, unfortunately, Cleantech ventures have involved long and inflexible technology and manufacturing process development. As HBS’s Carmen Noble observes:

While venture-funded Web companies can crank out a marketable prototype in a matter of months, clean-tech companies can take years to develop products—solar panels, batteries, biofuels, and the like. …it’s hard for a clean-tech company to deliver economically viable production volumes without massive follow-on funding.

Fortunately, long development cycles are not an inherent Cleantech characteristic.

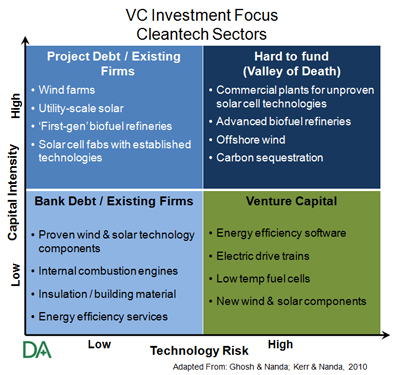

VC Cleantech Investment Focus

Business selection and operation

From an investment success point of view, there are two fundamental determinants of success – good investment selection and good business operation. Both are required.

If a technology is not amenable to rapid iteration, or requires very expensive and exotic test apparatus, it may not be a good fit for venture capital and should not be selected. The venture investing cycle is too short and the cost of capital too high.

VC investors like to seek out ‘game-changers’. To truly change any game, however, the underlying business opportunity must be amenable to rapid technology and manufacturing Process development. Even when the underlying technology is amenable to a flexible and iterative development Process, this path is not always taken. Management teams and investors do have influence over the business operation, and either group can sub-optimize a dynamic development process.

Nuclear Physicist Ernest Rutherford had some interesting thoughts on long-shots: “You should never bet against anything in science at odds of more than about 10-12 to 1”

Many Cleantech opportunities involve physical products and processes. Long Process development paths can be unavoidably inherent to the underlying technology. Careful selection can be the cure for such long-shots. At other times, though, they are influenced by management – or Board of Directors – motivation, knowledge and practice as well as by investor experience and expectations.

The greatest curse for any promising venture is to have the blessing of both excess time and money. The need for more of both will be the inevitable result.

The buffer of excess money and time enhances the risk of obsolescence and, more importantly, of veering off-course. Such buffers provide an opportunity for a management team to set an agenda that may not be strongly tied to the actual market.

Sometimes the lengthy development and high cost is by design. Other times, however, this may be due to a number of controllable or alterable factors. Long Process cycles:

- Obviate a sense of urgency

- Are inconsistent with Executive performance management and compensation criteria

- Are fundamentally misaligned with capital market, business, and market cycles

It is self-evident that:

“Firms that get to market faster and more efficiently with products that are well matched to the needs and expectations of target customers create significant competitive leverage.” Clark and Wheelwright: Managing new product and process development

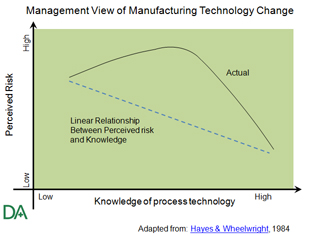

The novelty factor and perceived risk

Many Cleantech management teams have not had the benefit of experience in the rapid paced information industries. They may not even have experience with successful implementation of advanced manufacturing techniques.

Similarly, many venture investors are still relatively new to Cleantech investing. While venture investors may have an understanding of flexible development and manufacturing Processes, they may not be familiar with the underlying Cleantech technology. Moreover, with the emphasis on outsourcing in IT for the past decade or so, venture investors may not have a current or relevant manufacturing experience base. The outsourcing trend is underscored by the growth of the Electronics Manufacturing Services (EMS) industry, which tripled in size between 2000 and 2008. Meanwhile, VC dollars were being directed to Internet ventures. Thus in the last decade both old and new companies have moved away from manufacturing as a strategic competence.

The perceived risk that arises from this novelty, or unfamiliarity, factor can conspire to extend product development cycles and manufacturing process adaptation. Rather than decline with increasing knowledge, management’s perceived risk actually increases initially when the actual risk has decreased. Distorted views from risk-related concern can result in cautious and deliberate approaches becoming favored over flexible and adaptive approaches. Timelines become extended rather than diminished, and overall corporate risk is enhanced through sub-optimal decision-making.

Perceived risk of new approaches is one area where a little knowledge can be dangerous.

Origin and cultural legacy

Even management with extensive manufacturing experience can have difficulty adopting advanced manufacturing techniques. Organization culture can be an impediment to adoption of advanced manufacturing techniques. As Saberi (2010) observed,

“Successful implementation of (advanced manufacturing techniques) often requires dissimilar types of organization and or management practices than are found in more traditional environments.”

In many Cleantech areas there is no extensive legacy of start-up experience and success. The origins of many Cleantech innovations are based on:

- Fundamental materials science

- Enhancements for and from mature industries

- Activities in Academia, National laboratory and corporate R&D centers

Unfortunately, these situations are more likely to pursue deliberate, stage-gated experimentation than pursuing adaptive product development. Where these are the sources of a Cleantech opportunity, the management team may require augmentation with members that can champion adaptive Process.

Fast Cycle development advantage

Adapt or perish

Through the 1980s and 1990s, the IT industry led the way to new corporate cultures of Continuous Improvement and Learning Organizations.

Being fast and efficient is essential but not enough. The products and processes that a firm introduces must also meet demands in the market for value, reliability, and distinctive performance. Wheelwright & Clark: Revolutionizing Product Development 1992

Cleantech ventures must benefit from the lessons of the information industry. Otherwise good business opportunities will be squandered or picked over for those that most resemble the information industry and artificially restrict the overall growth and attractiveness of Cleantech itself.

Long development cycles in Cleantech are both bemoaned and even grudgingly accepted – but not pursued – by venture capital investors. Some venture investors are increasingly looking to pursue only those opportunities that most mimic opportunities in the information industry where they are most familiar.

As Ghosh & Nanda ( Venture Capital Investment in the Clean Energy Sector) observed:

One of the most important bottlenecks threatening the innovation pipeline in energy production is the inability of VCs to exit their investments at the appropriate time. This hurdle did exist in industries such as biotechnology and communications networking that faced a similar problem when they first emerged, and was ultimately overcome by changes in the innovation ecosystem.

Short, flexible development cycles allow for feedback, review, and correction. Flexible manufacturing design allows for low-cost and asynchronous modifications, enhancements and improvements. Long, rigid development cycles and tightly-coupled manufacturing processes are cursed by their inflexibility and self-restrict the ability to leverage the experience curve.

Steve Vassallo of Foundation Capital, Tom Zarrella of JouleX, and Jeffrey Immelt of GE at the Ecomagination Awards

Reducing the opportunity pool

Earlier this month at the Ecomagination Awards in New York, Steve Vassallo, General Partner at Foundation Capital, underscored this VC trend to invest in the familiar by observing that “Most good (Cleantech) ideas are in sensing and software.” Vassallo further commented that, “The demand side (monitoring and attenuating energy usage) is more capital efficient for venture capital and this is where a lot of interesting ideas will come forward.”

Steve Vassallo’s comments are well-founded. At the same time, some of the biggest Cleantech opportunities cannot be addressed by software or sensing alone. These opportunities must incorporate capital efficient approaches or they will lose the interests of leading VCs like Foundation Capital.

There have been Cleantech investments that can be questioned in 20:20 hindsight. At least one Cleantech investment has been labeled a Cashivore, adding a new word to the VC lexicon.

A lot of money has already invested in Cleantech and tremendous experience has been gained. There are lessons that can be applied to better exploit the tremendous opportunities that are still ahead.

What to look for

With respect to Process, investments should be evaluated for criteria that include:

- Clarity of objectives

- Rapid technology development path

- Short, fast-iteration (prototyping, etc.) capabilities – high speed to market

- Simple test infrastructure with strong feedback loops

- Market insight with excellent communication, information and market intelligence systems

- Fast market adoption potential to generate customer feedback and response

- Lean manufacturing, modest working capital requirements

- Modest commercial ramp expenditures (avoid Valley of Death)

- Multiple sources of manufacturing equipment for pilot and commercial production

- Clusters can provide ecosystems where Process advances can be quickly and broadly exploited

2 Responses to “The Cleantech Pillars: Process”

Trackbacks/Pingbacks

- Tweets that mention The Cleantech Pillars: Process | d-bits -- Topsy.com - [...] This post was mentioned on Twitter by Thealzel Lee: The Cleantech Pillars: Process - what to look for in…

- Beware the Cashivore | d-bits - [...] In fact, these guidelines are effectively represented by the VC Cleantech Investment Focus matrix as adapted from Gosh and…

David,

I love this addition to your Pillars series. A great follow-up to the GigaOm piece where I found your comment.

Have you thought about a white paper series as well? This is great info, but a lot to digest in a blog format!

Best,

Lynn

Thanks Lynn!

Maybe a PowerPoint instead – lots of pictures, less text.

Or, an example or two. Stay tuned.

Regards, David