The Cleantech Pillars framework is a new assessment tool for Cleantech ventures.

The four Pillars represent the generic contextual hurdles within Cleantech. These are the factors that differentiate Cleantech opportunities from more conventional technology ventures.

The four Cleantech Pillars are Plant, Process, Phase and Policy.

Plant and Process cycle are internally oriented business Pillars. These central pillars are flanked by the externally oriented Pillars of target market Phase and Government Policy.

Together, these four Cleantech Pillars can be applied as a screening and assessment tool to help separate Cleantech winners from marginal situations.

Pillar #1 – Plant

High capital intensity

High capital intensity is a commonly voiced concern amongst investors evaluating Cleantech opportunities.

Venture Capital is an expensive equity class. Spending Venture Capital dollars on machinery provides lower leverage than applying it to develop, fine-tune and market world-changing ideas. Physical processes and supply chains for physical goods are critical to many Cleantech opportunities, however. Just as replacing or enhancing our existing infrastructure offers many Cleantech opportunities, heavy infrastructure dependence is common across the Cleantech spectrum. Changing the electrical utility industry requires manufacturing, delivering, and installing lots and lots of stuff.

Concern over high capital intensity in Cleantech is well-founded.

Wide Range in Cleantech Asset Leverage

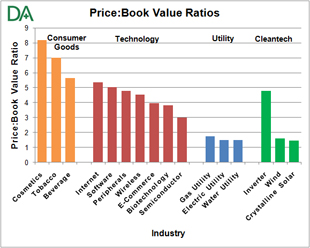

Judging from how publicly traded Cleantech companies are valued, there is currently very little price premium above basic asset value for Cleantech’s flagship wind and solar industries.

The public markets currently assign a value to wind and solar PV companies which is roughly equivalent to the value of their assets. In fact, the Wind and Crystalline Solar PV companies trade at lower Price:Book Value ratios than do the asset intensive Electric, Gas and Water utilities.

Not all Cleantech companies or industries have low Price:Book Value ratios. Notably Inverter companies trade at much higher ratios. Inverter companies have much higher capital leverage and do not have the same requirement for highly specialized capital equipment as do PV cell manufacturers, for example.

Capital intensity extends beyond manufacturing equipment

These process-intensive opportunities typically involve extensive value chains – and development costs – both downstream and upstream of the specific venture opportunity. The wind industry, for example, has placed a heavy burden on the transportation industry while also facing materials supply challenges for rotor blade manufacturing.

“The wind industry has pushed superload permits to astronomical numbers. Four to five are needed for each load. Transportation preplanning is critical to delivery.” Jay Folladori, Vice President of Heavy Specialized, Landstar

Solar, meanwhile, has generated headlines on raw material supply shortages whether for purified silicon for the conventional crystalline products, or for supplies of Indium and Tellurium for thin film.

In Cleantech situations, manufacturing equipment costs may represent only a portion of the operational capital required. Due to component shortages, lack of operating history, industry practice or other supply chain issues, capital may be required for prepayments on feedstock, financing extensive customer trials, performance insurance or placing physical product into the channel.

Manufacturing equipment is never a one size fits all solution. New entrants may require multiple equipment iterations – initially at lab, then pilot, and finally at full scale. Lessons from operational learning will require capital improvements before competitive benefits can be realized. Spending millions of expensive venture capital dollars on disposable capital equipment or on securing multi-year feedstock contracts does not provide high investment leverage.

Venture Capital not designed for Capital Assets

Such high capital intensity is a significant departure from the conventional Venture Capital model.

General Georges Doriot, the founder of the modern Venture Capital industry, observed that one of the primary problems for young emerging enterprises was a predominance of soft assets, such as patents and trade secrets, as compared to hard assets that are typically easier to finance through conventional capital sources such as capital equipment leases.

Though General Doriot described this as a weakness, low capital intensity has actually been a fundamental strength – or desired feature – within the venture capital industry. Reduced hard asset requirements provide leverage for higher returns.

Capital efficient business models have yielded some of the greatest venture capital success stories. Even today, with annual revenues in the billions of dollars and huge campuses and data centers, Microsoft and Google still have Price:Book Value ratios ahead of their peers.

Bob Lessin, Vice Chairman of Jefferies & Company, summarized this benefit of soft asset as one of his key Lessin’s Lessons (recently compiled into paperback) by coining the guideline of “Few Atoms, Few Assets”:

“You want to be as liquid as possible, to own as few assets as possible, and to outsource as much of the operation as possible. The premium should be on ideas and dollars. Do as much as you can over the Web: finance, distribution, sales, design, supply.”

What to look for

Cleantech is capital intensive by nature. Consistent with the example of inverter companies as compared to PV cell manufacturing companies, there are opportunities within Cleantech that offer higher capital leverage than others.

In terms of optimizing Plant, Operations and Supply Chain Management insights provide excellent guidance. Preferred Cleantech opportunities include those that:

- Have low to modest capital infrastructure requirements (e.g. High variable:fixed cost ratio; Production steps easily balanced with each other and/or easily separated; Early cash flow generation; Customer prepayments; Out-sourcing)

- Have a significantly reduced environmental footprint than competitive alternatives – especially that allows a competitive advantage in terms of leveraging market access (e.g. on customer premises) or exploiting infrastructure or supply access.

- Have a fundamentally different (higher leverage) capital model than existing competitors (e.g. Dramatically lower capital cost per unit of output capacity; Faster scalability – the ability to add new capacity quickly in order to achieve revenues sooner)

- Leverage, or otherwise enhance the value of existing infrastructure and supply chain

- Improved process intelligence (e.g. sensing/metering), and the expertise, awareness and commitment to leverage IT, ERP and accounting systems

Stay tuned to d-bits.com for future posts offering insight into the other Cleantech Pillars.

No Responses to “The Cleantech Pillars: Plant”

Trackbacks/Pingbacks