Cleantech is not a singular industry. There are many industries that have Cleantech opportunities. The maturity of the specific Cleantech target industry, its Phase, can have a powerful influence on Cleantech business success.

Cleantech is not a singular industry. There are many industries that have Cleantech opportunities. The maturity of the specific Cleantech target industry, its Phase, can have a powerful influence on Cleantech business success.

While Phase issues do exist in other industries, Phase challenges in Cleantech targets are considerably more pronounced. Target industry Phase should be considered in market selection, business strategy and even management hiring decisions.

Information industry comparison

In contrast to many industries that represent Cleantech targets, the information industries have entire ecosystems that are built on technical integration and synergistic cooperation. This is true even in the face of severe competition between the same players.

Information industries can rapidly evaluate, adopt, integrate, refine and advance new technologies. Some information companies, such as Cisco, have excelled by driving innovation explicitly through a “build, buy and partner” growth strategy. Standards do change, and can rapidly evolve between platform change cycles.

Even with a culture of change and adaptation, platform change is more discrete than continuous. In the Growth Phase, for example, sustaining innovations are favored over platform replacement or disruptive innovations.

Consider the optical storage format war. The launch of a new optical storage platform immediately after Blu-Ray successfully emerged would almost certainly suffer the same fate as the abandoned HD-DVD technology – only faster. This effectively did happen with Warner’s Total Hi-Def platform. Enhancements to the Blu-Ray platform, however, have been quickly adopted.

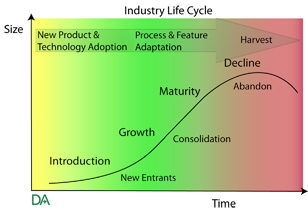

Industry Life Cycle

Cleantech opportunities weighted towards mature industries

Cleantech opportunities typically involve:

- Industries in the Maturity or Decline Phase

- Advancements for mature products in these industries

- Highly regulated or resource sectors

- Some combination of these situations

In the mature or declining Phase of an industry, conventional strategies for incumbent participants range from a hold position to a withdraw and abandon strategy.

Unlike the newer information economy, the older industrial economy – often huge, byzantine businesses – may not have strong models of technology adaptation and adoption. Or, if they once existed, may have long passed. These industries can have structural and cultural barriers to new technology integration.

A classic business plan red flag is when success is contingent on changing user behavior. Successfully introducing new technology solutions and products into older industries, however, can require a fundamental change to a century-old operational model.

While the markets are seductively huge, the challenges for new entrants can be Sisyphean or futile. To succeed in mature industries, an alternate approach may be required such as Nucor Steel’s employment of a disruptive strategy in its introduction of the steel mini-mill. As Nucor’s disruption of the steel industy demonstrated, sometimes incumbent players cannot adapt even to assure their own survival. Nucor is now the fourteenth largest steel producer in the world, and one of only two US companies in the top 30.

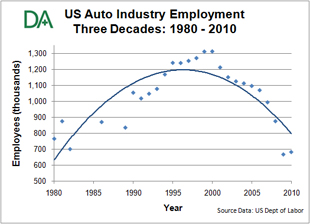

An Industry in Decline

Auto industry perspective

Pictures of tailpipe fumes have been a galvanizing image for the green movement since California introduced automotive emissions standards in 1966. Affecting change in the auto industry, however, has been a long, slow battle.

Due to its size, influence and maturity, let alone its importance as a Cleantech focus, the auto industry is an instructive proxy for the ‘old industrial economy’.

The auto industry is a good example of an industry in the Decline Phase. According to KPMG’s global 2010 Auto Survey, “Overcapacity is now critical.” In fact, even “Emerging markets are becoming overbuilt.”

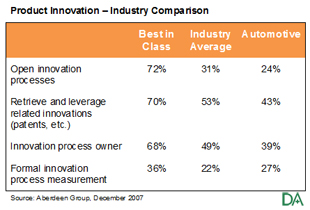

The Automotive industry’s innovation capability is consistent with the Decline Phase. According to analysis by the Aberdeen Group, notably conducted before the current global financial crisis, the auto industry is an innovation laggard. There is only one area where the auto industry is even close to other industries. Ironically this is in formal measurement of innovation performance.

Executive hiring

Humans are creatures of habit. Executives need the right habits for managing the business. Executive hires should be business Phase appropriate, rather than industry Phase appropriate, even in deference to target industry knowledge. This is especially true in Cleantech where the new entrant’s business Phase – typically an Introduction or Growth Phase – can be so different from the target industry Phase – commonly the Maturity or Decline Phase.

Earlier stage, technology driven enterprises require executives to successfully direct innovation, not those that can only measure innovation.

New ventures are in an Introductory Phase by definition and must successfully transition to Growth Phase. Increased industry knowledge cannot overcome burdens of workplace culture, systems and management practices modeled on experience in declining industries. A successful venture should not be seeking expertise in downsizing, rationalizing and liquidating.

Inflexible industry culture and adversarial workforce relations

Cooperative competition initiatives – coopetition –are now a decades old concept from the information industry. Today’s Silicon Valley startup could be tomorrow’s Google with its own ecosystem. The old industrial model, however, operates with a high degree of integration, centralized R&D and highly stratified and specialized supplier tiers with modest technical innovation capability.

The inflexibility of centralized integration and highly stratified supplier tiers at US automakers opened the road for the Japanese auto makers. The GM culture, for example, developed around a ‘visible hand’ of internal management and a singular center for experimentation.

The Japanese industry, in contrast, built itself around the concept of an ‘invisible handshake’ for strategic partnering and purchasing. The Japanese model provided stronger incentive for technical change – including within the industry suppliers. Even with the ongoing downsizing in Detroit, there is still a much higher degree of centralized labor in the US auto industry. The Japanese auto industry, of course, is also in the Decline Phase and is now attracting more attention over quality challenges than innovation success.

Compounding challenges of culture and technology partnering affinity, workforces in late Phase industries are more likely to be inflexible and highly stratified. Implementing change can be thwarted if it is perceived as a fundamental workplace threat.

Additional impediments such as strong unions with embittered management relations may be present. Industrial relations and workplace culture along with management focus and practice are common barriers to technology change in the Decline Phase.

Going against conventional business strategy

For over four decades since BCG developed the product portfolio, corporations have been advised to pursue a strategy of harvesting and exiting their mature product businesses.

The conventional strategy is to harvest cash from a low-growth, high cash producing ‘Cash Cow’ and re-invest to propel high-growth ‘Stars’ while restructuring ‘Question Marks’. According to the BCG doctrine, “(Dogs) are not necessary.”

For Cleantech situations, however, it is the mature products and industries – Cash Cows or Dogs – which represent the greatest market opportunities. For Cleantech initiatives to succeed, this basic harvest strategy must be reversed and reinvestments made in mature products and businesses.

Addressable but not accessible

A standard evaluation criterion for venture businesses is the presence of a large Total Addressable Market (TAM). Due to the size of these mature industries, the TAM can appear huge.

Addressable Market: the total potential market for a product or service, i.e. the total potential sales if there were no competition present

When it comes to Cleantech, however, these large addressable markets may have considerable accessibility challenges. They may lack core capability in terms of culture and values, skills, systems and managerial capacity to rapidly adopt new technologies into their products and operations.

For mature and declining industries where an addressable market might exist, it may not be accessible. The addresses are known, but the doors are out of reach.

With Cleantech, Phase issues can prolong the market adoption cycle. There may be great solutions to large societal and industrial problems representing enormous potential business opportunities. But many Cleantech target markets are slow-moving and/or have cultural impediments to new technology adoption.

What to look for

In terms of optimizing Phase, preferred Cleantech opportunities include those that have:

- Strong, positive market momentum – target industry not in maturity or decline

- Executives that are business Phase appropriate

- Small, identifiable customer(s) who understands pain

- Early, accessible revenue to establish traction and gain customer commitment and focus

- Information sharing and accessible customer demonstration, trial, prototyping capabilities and capacities

- Strategic partnering opportunities with firms that have a successful model of open technical development and advancement

- Addressable and accessible markets

In addition, optimal strategies may require

- Building sub-sector ecosystem(s)

- Pursuit of a disruptive strategy, with the risk that this entails

Stay tuned to d-bits.com for future posts offering insight into the other Cleantech Pillars.

7 Responses to “The Cleantech Pillars: Phase”

Trackbacks/Pingbacks

- Tweets that mention The Cleantech Pillars: Phase | d-bits -- Topsy.com - [...] This post was mentioned on Twitter: Just published "The Cleantech Pillars - Phase" http://bit.ly/dBXJgh. If you read about only…

David:

Very thoughtful piece. As I look to enter the industry from a career in IT, I realize I’m going to have to shift my thinking about industry dynamics. I’d love to discuss with you more.

Thanks David. I am flattered!

Thank you David for developing such a useful assessment framework. I first read your post introducing the Cleantech Assessment Framework – can I say (CAF)? in October, and now a continuation in this post. I found it valuable to understand how ‘Phase’ considerations can deeply affect the entire business value chain.

I related the Phase challenges in Cleantech to my experience in delivering high-tech solutions to the mining industry. What you described as typical characteristics for Cleantech opportunities applied here too:

• Mining is in the Maturity phase.

• Advancement for mature products in mining.

• It is a highly regulated resource sector.

The mining industry shares many characteristics with the mature traditional manufacturing industry in terms of its slow adoption and investment in productivity innovation. Most of the successful productivity improvement solutions are attributed to suppliers and equipment manufacturers from outside the mining industry. Thus entrant versus target company ‘phase’ understanding becomes very relevant.

As you wrote, a strong barrier to success in introducing new tech solutions into older industries can be the requirement to fundamentally change century-old operational models. Success here is certainly contingent on changing user behavior. I found that good change management processes geared towards deployment and adoption issues were not enough. There was a fundamental and deeply entrenched challenge, when we as the entrant’s business were in the introductory/growth phase (providing a high-tech mine productivity solution), with a target company in the maturity/decline phase.

There is a massive accessibility challenge when dealing with a strong target industry culture: the mining industry had deep functional hierarchy with complex operational silos largely preventing rapid (or may I say even medium-time) adoption of new technologies into their operations. Thus far, this has proved insurmountable to change from the outside-in. It would be very helpful to drive dialogue using CAF as a base so that we could start strategizing effective solutions to this challenge. It’s just a question of time before this is essentially required.

Thanks again for leading this process!

Thanks Sasha.

Introducing new technology into the mining industry is an intriguing challenge.

I have a picture of the Grand Canyon that I was thinking about using to describe this particular ‘Crossing the chasm’ challenge.

But, Phase mismatch isn’t as simple as just crossing a giant canyon – or open-pit mine – as you have illustrated.

David, appreciate this helpful information & perspective. Especially as it pertains to Executive Hiring …another dimemsion to be considered wrt business phase vs industry phase.

Thank you

Thanks Doug! Considering your expertise here, this is much appreciated.

USA Today’s front page article Nov 16:

Energy rebates on appliances don’t move water heaters

With a mature building stock, the USA Today article underscored how the mature industry, combined with buyer behavior and market channel, has not benefitted from large $300 rebates for replacement water heaters.